It is amazing how quickly half-truths can turn into seeming full truths. Commercial landlords will certainly already be tired of the column inches committed to condemning Covid-19 for choking the life out of traditional retail models.

No one is denying that the succession of lockdowns has played a part in accelerating a decline, but the demise had begun long before the concept of social distancing arrived on the UK’s streets.

Take, for example, John Lewis’s announcement that it would be closing eight of its stores. While the headlines were quick to attribute the cause to Coronavirus, the retailer acknowledged the shops were “challenged prior to the pandemic” and that it expected 60% to 70% of its future sales to be made online.

Internet shopping is not a phenomenon that just emerged during lockdown – it can be traced back to the 1990s.

This is of little consolation to those having to accept retail’s new world order or the landlords worried about witnessing an exodus.

Ironically, it is two of the protagonists applying the pinch to retail’s old guard that could prove the latter’s saviour.

Those premises long courted for retail warehousing – buildings away from heavy traffic but within reach of homes – represent an appetising proposition for those facilitating online trading.

We refer not to the coding talents behind virtual shopfronts, but those responsible for getting goods from your digital basket to your doorstep and the facilities that power internet marketplaces.

For the former, the businesses needing a stepping stone between depots and delivery, the appeal of satellite sites is clear. They have a need for logistical sweet spots to facilitate couriers charged with a supply chain’s ‘last mile’.

Similarly, these locations are ideal for data centres – the behemoths fuelling commerce in cyberspace – as they are closer to the areas they serve: places promising a reduction in latency and a hike in service speeds.

Retail’s shift in need will undoubtedly drive change across the country’s commercial estate. However, with change comes opportunity, and out-of-towners trading places with the current tenants situated on the outskirts of our cities could provide a sustainable solution.

Facilitating this migration is not, of course, as easy as exchanging keys. Any ‘house swaps’ will require a degree of repurposing, and a change of use poses a dilapidations dilemma both for landlords keen to preserve the value of their investments and outgoing tenants seeking to minimise exit costs.

This ‘last-mile’ portion of the process can be difficult. When trading places, be mindful of dilapidation settlement delivery and the investment values through repurposing.

Huw Dixon is co-founder and partner and Christopher Tanner a partner at HartDixon

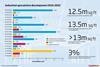

Industrial & logistics sector continues to boom

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

Currently reading

Currently readingThings to be wary of when trading places

- 10

No comments yet