Anyone hoping the grubby issue of ‘dirty money’ had gone away after David Cameron’s threatened crackdown last year was rudely disabused of that notion this week as the Panama Papers lifted the lid on the extent to which the world’s rich use tax havens to hide their wealth.

Needless to say, the 11.5 million documents leaked from law firm Mossack Fonseca reveal significant offshore ownership of London property assets with those mentioned including the president of the UAE, Sheikh Khalifa bin Zayed Al Nahyan, who owns £1.2bn worth of central London properties. Somewhat embarrassingly for the PM given his crusading zeal last year, his late father’s investment fund was also named in the leak.

Creating an offshore vehicle is perfectly legal, of course. However, the anonymity afforded by such structures opens them up to abuse by criminals - and it is no surprise that other names divulged include characters with less-than-pristine reputations, such as Soulieman Marouf, fixer for President Assad of Syria, and Bukola Saraki, the president of the Nigerian senate, who has been charged with corruption.

Neither is it any surprise that the British Virgin Islands is the most popular tax haven used by Mossack Fonseca, home to 113,648 companies named in the leak. As we revealed in our investigation last October (‘Just how dirty is offshore money?’), the jurisdiction was second only to Jersey as a source of offshore money, the crucial distinction between the two being that the former offers near-complete confidentiality to companies registered in the territory whereas Jersey is a well-regulated jurisdiction with full knowledge of the beneficial owners of companies registered there.

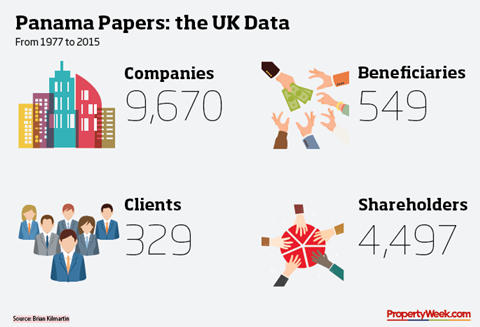

The scale of UK involvement in the Panama Papers

According to German newspaper Süddeutsche Zeitung, 9,670 UK companies are named in the data cache, covering the period from 1977-2015, while 329 of Mossack Fonseca’s clients were from the UK.

This is considerably more than the US: the data names 3,072 US companies and 441 clients.

A further 549 UK beneficiaries are named, along with 4,497 shareholders.

Not that this is a distinction Joe Public is likely to appreciate when a staggering £263bn of offshore money has been invested in property in England and Wales since 2000 - and some parties seem hell-bent on tarring it all with the same dirty-money brush. What with the tantalising prospect of salacious stories about foreign criminals and the more prosaic correlation between offshore money and soaring London residential prices, the fear now is that the industry will be subjected to a “witch hunt”. It doesn’t help that the UK seems to be particularly implicated in the Panama Papers, with 9,670 of the companies named and 329 of Mossack Fonseca’s clients hailing from the UK, compared with 3,072 and 441 respectively from the US. Indeed, more than half of the companies are registered in British-administered tax havens, as well as in the UK itself.

So what to do? Some are trying to play down the potential impact, but the worst thing the industry can do is bury its head in the sand. It might seem like a huge data set, but Mossack Fonseca is just the tip of the iceberg. More names will be implicated and they will prompt more calls for action.The industry needs to put its house in order - the scale of the problem in the UK shows just how inadequate the current checks and balances are - or the likes of Jeremy Corbyn will fill the vacuum by calling for the UK to impose direct rule on tax havens. Oh, wait a minute…

No comments yet