I will happily venture outside my comfort zone if I think I’m up to it and it’s worth it, but let’s just say there are three good reasons I will never undertake a triathlon. I have to seriously question, therefore, the wisdom of councils venturing beyond their skill sets and comfort zones to invest eye-watering sums in commercial property, not just in their boroughs but outside.

As we reveal in this issue, local authorities bought nearly £1bn of commercial property in the first half of 2018 – almost 50% up on the same period last year. Total spend, meanwhile, has soared a whopping 1,868% since 2014 to account for 3.4% of the market versus 0.2%.

That is quite a leap into the unknown. Of course, there are those who argue that councils have no choice in light of funding cuts; they have to find alternative sources of income to pay for basic services.

However, many observers are growing increasingly concerned about the sheer level of investment, questioning whether councils are taking proper advice and making sensible decisions – or being mugged off on price because they can borrow money so much more cheaply than anyone else.

Full data analysis - Local authorities splash out £4.1bn on commercial property

There is particular concern about the levels of council spending outside their jurisdictions. Industry experts are not the only ones who are alarmed.

In a fascinating interview with Property Week, Lib Dem leader Vince Cable describes it as “utterly perverse” that councils cannot borrow money to build much-needed homes, but can borrow to invest in commercial property outside their boroughs.

So worried is he that we will have a repeat of the Hammersmith and Shetlands debacles (for those too young to remember, the former fell into financial difficulties in the late 1980s after investing in derivatives and the latter made huge losses on the stock market in the early 2000s) that he raised the issue in parliament. As he warns in characteristically blunt language: “Potentially, they are going to end up with egg on their faces.”

Cable is not so bothered about those investing closer to home, where they are in it more for the social impact than the dosh. When it comes to shopping centres, they could even be preferable to the existing owners, claims APAM’s Simon Cooke.

The asset management firm estimates that up to 200 shopping centres worth £7bn are at risk of breaching their covenants. Cooke blames the sector’s woes partly on the large number of private equity owners that have entered the market since the financial crisis.

Unfortunately, they have invested next to nothing, preferring to sit on the income, says Cooke, who believes that the sector would benefit massively from more long-term investors coming in – such as local authorities.

Tellingly, the Savills data shows that councils have not bought a single shopping centre outside their jurisdictions, so Cooke appears to be preaching to the converted. If only some of them could show a bit more common sense with their other assets…

The final countdown

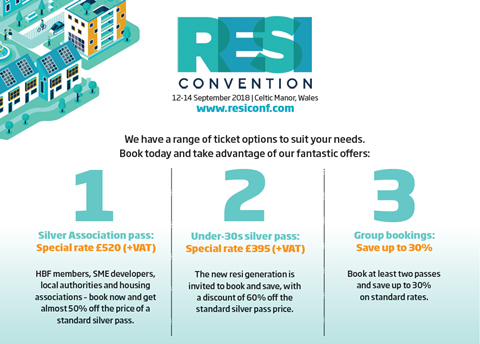

Still not registered for the all-new RESI Convention? You’d better get your skates on! For more information about this year’s event, which is themed ‘Debate. Diversity. Delivery’, go to www.resiconf.com.

To book your ticket, go to www.eventbooking.uk.com/resi. I hope to see you there.

No comments yet