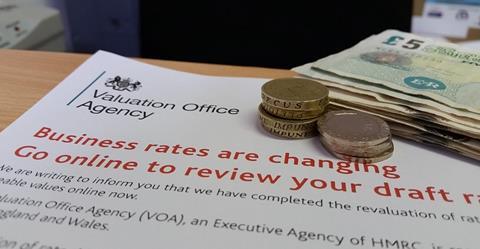

2018 was certainly a tumultuous year as far as business rates was concerned with the impact of the 2017 revaluation hitting home.

Some companies, particularly retailers in central London, saw their business rates rise at unprecedented levels, whilst others, who should have seen their rates bills fall, suffered from the policy of transition and so are still paying bills higher than they should be- or indeed can afford to.

The difficulties facing many retailers has been chronicled extensively – the fact that physical stores paying expensive rents and rates just can’t compete with the internet providers, who of course don’t pay business rates to the same extent. We’ve seen a plethora of shop closures, job losses, CVAs and companies going into administration. Sadly, it does not look like 2019 will give us much of a reprieve.

Here are five business rates-related predictions for the year ahead:

-

The long running ATM case continues

The case about whether ATMs in stores should be separately and additionally taxed for business rates, is likely to run and run. The VOA has requested permission to appeal to the Supreme Court to overturn the Court of Appeal’s recent findings in favour of the ratepayers (the retailers). Counsel has advised that if the Supreme Court agrees to listen to the appeal it could take between 14 and 22 months to actually hear the case and that any decision following a full hearing will not be made until between June 2020 and March 2021, with implementation 12 to 24 months later. If the supermarkets are successful this will impact not just on the refunds they are entitled to from the 2010 rating list, but also those from the 2017 and possibly 2021 lists too- a huge amount of backdated refunds to await. Currently, the amount of potential refunds held up in this process stands at about £500 million. I hate to think how much they will be by 2022 and how the retailers will fare in the meantime without these much-needed funds returning to their coffers. -

CCA , will continue to grind to a halt

The new Check Challenge Appeal Business Rates appeals system has had issues since it was launched. According to a FOI request by Colliers last summer, 87% of users trying to get their business rates checked were dissatisfied or very dissatisfied with the system. This was out of 2590 respondents in the 17-month period since CCA was introduced in April 2017. Over complicated procedures, lack of guidance and a largely un-navigable on-line portal are discouraging those with good cases from challenging their bills. Latest figures show only around 51,000 checks have been lodged in England since April 2017 and there are still 11,000 outstanding. And only 6,500 have gone onto the Challenges stage, a ridiculously low number, of which 4,000 are still outstanding. This is shocking for eighteen months into the list. There is unlikely to be much improvement in 2019, as the protagonists ignore all complaints and insist the system is working. -

VOA will continue to be under resourced

Last year, the VOA announced it was reducing the number of locations in which it has offices from 52 to 26 and it appears that by 2023 it will only be in the main UK cities, with a London presence solely in Canary Wharf. Numbers of staff are being cut and this is at a time when we are moving to a new rating list in 2021 (for which assessments need to be done two years earlier- i.e. April 2019) and after that to three yearly valuations. The VOA just won’t be able to cope with the strain. No wonder so many people are leaving its service. -

The final straw for many retailers

Already struggling this winter, some are culling shops and staff now. Laura Ashley has announced it is closing 40 shops, putting hundreds of jobs at risk; following the well-worn path behind chains such as New Look, M&S and House of Fraser. Others holding out through winter will face business rates rises in the Spring as the third year of staggered increases since the 2017 Revaluation feed through. We could very well see the multiplier (the rate poundage against which the rateable value of the property is multiplied to give the final rates bill) rise to over 50% for the first time ever. For some that have held on through the Christmas trading period, such rises could be the thin end of the wedge and sadly I forecast more closures and job losses in the year ahead. -

Government will do nothing to help this situation

There will be no much needed business rates reform, so pre-occupied is the Government with its Brexit negotiations. The pathetic measures in the last Budget giving relief to the smaller traders did nothing to help the major retailers who are the ones we now see on the CVA lists and the ones culling jobs.

To say the government is asleep at the wheel is a kindness. They are wide awake - just driving remotely at a brick wall. If there is one thing for certain in 2019, it’s that the wall is getting ever closer and worryingly there seems no one in the driving seat.

No comments yet