Investors and developers in the built environment sector are not only recognising the importance of environmental, social and governance (ESG) factors in assessing long-term growth and risk, but they are now taking action to protect their interests.

An increase in the disclosure of ESG-related data has made it easier to assess the financial impact of ESG risks and include them in investment models. In the built environment sector, there has been a focus on measuring and managing energy and water consumption and production and, during development, materials sourcing and air quality standards.

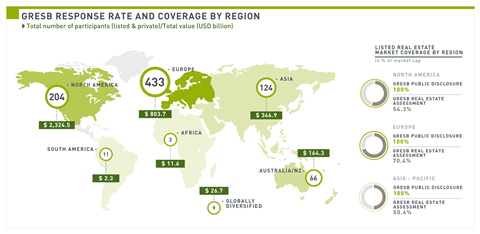

Signs that expectations are changing include the uptake of disclosure tools and guidance. Last year, 850 funds and property companies took part in the Global Real Estate Sustainability Benchmark (GRESB) Real Estate Assessment, suggesting that ESG disclosure is becoming market standard. New RICS professional standards and guidance being introduced in May will focus on the whole carbon lifecycle, including real estate construction and use.

Public interest has also driven ESG awareness. For example, the WELL Building Standard can be partly attributed to public demand and people’s desire to live and work in environmentally friendly, sustainable buildings that promote health and wellbeing.

Investors are also driving increased focus on ESG. While real estate investors’ main focus is still environmental risks, there is an increasing awareness of the importance and potential impact of social and governance factors.

The principles for responsible investment include commitments to incorporate ESG issues into investment analysis and decision-making, as well as reporting on progress towards implementing the principles. The UK Corporate Governance Code, the EU Non-Financial Reporting Directive and the UK Companies Act 2006 all require companies to report on the impact of their operations and how they manage social and environmental challenges, giving investors the information needed to make investment decisions.

For property investors, making decisions in line with ESG factors can be financially advantageous. For example, reducing waste and improving energy efficiency can bring long-term savings, while good corporate governance can help avoid reputational damage.

By refining its approach to ESG and producing clear and consistent reporting, the built environment sector should be better placed to instil investor and public confidence, identify and manage risk factors and achieve sustained financial performance.

No comments yet