Almost three years after the National Infrastructure Commission (NIC) was set up to independently assess the state of British infrastructure, it has released its first-ever National Infrastructure Assessment (NIA).

The fact that an assessment with such depth and breadth exists at all is welcome news for many in the industry as it is the first time a government-appointed body has attempted to analyse infrastructure holistically.

However, property experts are also acutely aware that the NIA’s proposals need to be followed up with action if the UK is to reap their benefits.

At 163 pages,the NIA is not lacking in detail or ambition. Its objective is to both describe the state of national infrastructure as well as prescribe future policies.

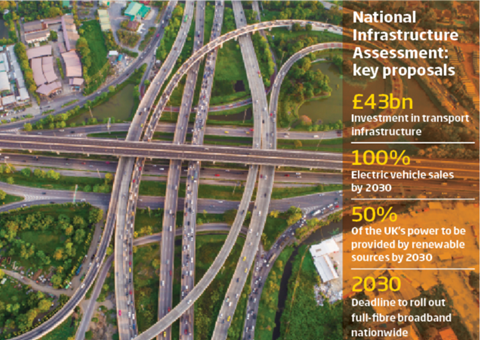

Some of the principal ideas from the paper include a £43bn investment in transport infrastructure; increased responsibility for metropolitan mayors to help deliver regional-level planning; and preparation for the UK to have “100% electric vehicle sales by 2030”.

The NIA also calls for half the UK’s power to be provided by renewable sources by 2030; the establishment of a plan for both extreme drought and flooding; and the roll-out of full-fibre broadband nationwide by 2030.

Some of the most ambitious proposals relate to energy use. The NIA argues that the UK can meet its commitments to low-carbon energy without raising bills and without much change to the way we currently consume energy. However, in order to do that, it says the UK needs to make the right investments today.

“The commitment to energy is the thing that stands out the most,” says Ben Heatley, director of Copper Consultancy. “The NIA lays down really firm groundwork for a transition to a low-carbon, renewables-based economy.”

Heatley’s view is that this won’t just have an impact on property; it will affect all aspects of life and business across the UK.

This interconnectedness of different economic sectors is another key point from the NIA. It argues that property and infrastructure should no longer be considered as separate sectors.

Integration is essential

“The message that has come through is about integration,” Heatley says. “Where there is property growth, infrastructure needs to be delivered alongside it. The two are symbiotic.”

Richard Olsen, executive partner at build-to-rent developer Cortland Partners, feels that the integrated approach recommended by the NIA will help residential developers immensely by making their product more attractive to consumers.

“Our experience is that many residents may prefer to live outside city centres and enjoy a more relaxed quality of life,” he argues. “However, this is often prevented due to lack of sufficient infrastructure.”

Olsen believes that the NIA’s plan of combining infrastructure creation with housebuilding could solve this problem.

“Where there is property growth, infrastructure needs to be delivered alongside”

Ben Heatley, Copper Consultancy

Colin Wood, managing director of transport in UK and Ireland at engineering and construction giant AECOM, concurs with Olsen. “From a property perspective, infrastructure is needed for economic growth in an area,” he says.

To deliver the simultaneous development of property and infrastructure, the NIA recommends giving metropolitan mayors more power. Heatley likes this suggestion, saying there is a great need for “beefed up urban centres with metro mayors who can deliver a growth agenda”.

Wood also agrees, believing it is vital that infrastructure is “not planned in a vacuum”. He believes metro mayors and city leaders should consider the whole picture when developing long-term strategies.

Both Heatley and Wood see the holistic approach to infrastructure backed up by regional-level power recommended in the NIA as a step away from the “piecemeal” approach of planning agendas of the past.

An ‘unplanned’ country

This is not the first time in recent months that there has been a call for this sort of change to planning and infrastructure. Last month, the Raynsford Review of Planning argued that decades of tinkering with the planning system had created a lack of continuity across local, regional and national infrastructure, which had led to an “unplanned” country.

Meanwhile, the locally-led new town development corporation (LLNTDC) regulations released last month introduced a process whereby local councils can create corporations capable of delivering entire towns, rather than just single developments.

Much like the NIA, the Raynsford Report and the LLNTDC regulations are seen by many as a rejection of the “piecemeal” approach and a move towards more holistic, cross-sector, regional-level planning.

“Clearly, a theme is emerging,” Heatley says. Wood agrees, noting that “the themes of the Raynsford Report and the NIA are broadly similar”.

However, if any of these recommendations are to be put in place, both the state and private sector will need to engage with the NIA’s proposals. While this would be a major undertaking, Heatley, Wood and Olsen are all optimistic that it can happen.

“This is the single most important initiative after Brexit and there is huge political pressure to see these policies implemented,” Olsen says. Heatley adds that “some of the core ideas from the NIA are already coming to pass”.

Challenges

However, even with the best intentions, Heatley admits that there will be challenges. He worries that political short-termism may scupper long-term commitments to infrastructure projects.

“Infrastructure operates in decades, whereas a week is a long time in politics,” he says. “No parliament can bind the next parliament.”

Heatley points to Heathrow’s expansion as an example of a long-term infrastructure project that the current government supports but the opposition does not.

While Heatley expresses concerns about whether the government will support the NIA’s proposals, he is less concerned about them winning private-sector support. He accepts that investment cycles are hard to predict and stresses that there are “no guarantees”, but is confident that if the government moves forward with the NIA proposals then private-sector investment will follow.

“The private sector is increasingly alive to the challenge of investing in infrastructure,” Wood states. “So it’s fairly likely that the government and the private sector will work together on these ideas.” Olsen feels the same way. “I fully support these initiatives and would work with the government to achieve them,” he says.

Another challenge is that, as with so much else in the UK, Brexit looms large over the NIA.

“One of the biggest hurdles to investment in major infrastructure projects is political uncertainty,” Heatley argues, adding that political uncertainties don’t come much bigger than those surrounding Brexit.

EIB funding concerns

The potential loss of European Investment Bank (EIB) funding because of Brexit is a perfect example of Heatley’s concern. The EIB has invested in some of the biggest infrastructure projects in the UK and it remains unclear whether it will continue to do so after Brexit.

Despite Wood’s confidence in the private sector, many experts find it hard to imagine that it will invest in infrastructure on the same scale as the EIB. As Heatley points out, the private sector tends to follow state investment rather than lead it. If the UK does lose EIB funding, it will be up to the government to encourage private sector investment by making the first move.

The NIA’s ideas have a lot of support from both the public and the private sectors, but the lack of guarantees about the economic and political impact of Brexit and continuation of EIB funding could change all that.

The excitement about the NIA will have to be maintained in the face of political instability if long-term action is to be taken to implement the report’s proposals.

No comments yet