Property Week and Aecom’s Cities of the Future report reveals how the urban landscape needs to adapt to grow over the next 25 years

Nothing puts the spotlight on a city like an Olympic Games. This summer, every aspect of London’s make-up will be scrutinised, from the efficiency of its transport network and infrastructure to the success of its public spaces. And, as millions of workers prepare to share their city with millions more tourists, the capital’s ability to prove that it is a place for living and working, as well as enjoyment, will be the biggest task of all.

But long after the last medal is won, London will continue to face the same challenges. As the capital city, its role in driving growth, prosperity and social well-being for the UK is constant and to achieve all that it must remain an attractive destination. What is changing for one of the most pre-eminent global cities, is that these pressures are about to get much more intense.

Over recent weeks, Property Week and Aecom, the multi-disciplinary urban development and infrastructure consultancy, surveyed hundreds

of readers for views on how London and its European neighbours need to change to thrive in the future. The results, published in the Cities of the Future report, were stark, and show that creating a successful, attractive built environment that promotes economic growth will require a different approach from developers, planners and politicians.

Global economic integration, technological change and rapid urbanisation mean cities are transforming into ever-denser networks of people, goods and information. But framed within the context of a low-growth climate and lack of finance, developing the right kind of environment for that progress is difficult.

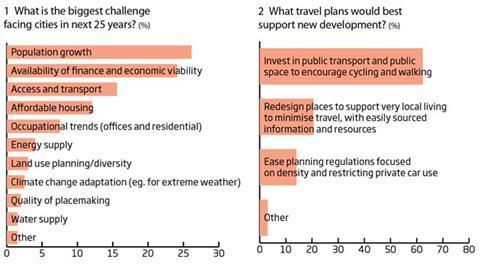

Urbanisation is a trend most respondents focused upon. More than half believe population growth is the biggest challenge cities face over the next 25 years, closely followed by the availability of finance. Access and transport also featured high on respondents’ agenda (graph 1, below).

Urban development specialist Alex Davey, who came from Davis Langdon and now leads Aecom’s European real estate team, is not surprised by the findings. “The United Nations estimates that 60% of the world’s population will live in a city by 2030. Population growth is a good problem

to have when it comes to development opportunities, but if there is limited finance for affordable housing or transport, then what does that mean? For example, how does it impact on financing and investment models for the residential property market in the future?”

Trains and drains

The survey seemed to confirm that viable development will be more dependent than ever before on infrastructure — both in terms of transport and water and waste management, as well as on the quality of public spaces.

Of those who said population growth was one of the three biggest challenges, 56% went on to say that investing in public transport and public space to encourage walking and cycling was the most useful thing a city can do to support the viability of new development. More than 60%

of respondents overall said this was the most important factor (graph 2, above).

Redesigning places to support “very local living to minimise travel” was the second-biggest factor in making schemes viable, respondents said.

But as one put it, it is not just the availability of infrastructure that is important, but the quality: “Connectivity, sense of identity, place shaping and affordability [are important components]. Places and people have to be connected, and, if cities are to grow and development is to satisfy demand, then transportation has to enable this.”

A city’s environmental assets matter, too. For cities, two things essential for economic growth are the right kind of citizens and the right kind of companies. Attracting them depends not only on the depth of a job market, but on whether a place is a safe, clean and green environment with high-quality infrastructure and public spaces. This notion was echoed in the survey results and, for many respondents, these emerging trends in the occupier market, combined with population growth, will present developers with a broader remit of concerns when defining schemes.

Davey explains: “New media and IT companies are often attracted to a city by the quality of the environment, because it allows them to attract a high-quality workforce. This could mean environmental credentials impact on the value of property.”

Yet, the pressures of space in cities mean developers need to create value with less, the survey concluded. With space constraints in city centres, the quality of homes being built should be high, and they should be sustainable to remain appealing, as one respondent said.

“Residents will vacate cities,” one feared, in response to the question of how population growth will impact on property use.

“Smaller properties [will be developed] because of lack of land,” said another.

As lack of access to mortgage finance for many would-be homeowners affects the build-to-sell market, this may be a challenge developers need to address in the private-rented sector.

But increasing integration will not only mean taking account of how transport and buildings relate to one another. Biodiversity could be key

in enhancing a city’s social and economic — as well as environmental — capital, said respondents. Around 65% believe that the increased protection of ecosystems would be vital to the health and sustainability of cities over the next 25 years.

There was also concern over the provision of infrastructure for the management of waste and water. Waste had been one of the biggest infrastructure challenges in recent years, thought 42% of respondents, while 67% expect all developments to be fully integrated with the water cycle within 25 years.

The quality of development in cities may also affect values of the surrounding areas. Metropolitanisation — whereby large cities influence the health and prosperity of wide regions and countries — was not recognised as an issue within the context of the UK.

Respondents were concerned that population growth would continue to only inflate values in London and the south-east of England, while in the north-east they would fall as people move to find work.

“Inadequate local and inter city facilities have the effect of holding back growth and development,” said one.

But London won out compared with not just the regions but other cities in Europe. Places such as Warsaw, Bucharest and Istanbul are regularly heralded as the most exciting emerging markets, but the UK capital gained more than 60% of the vote as the top city in which to invest (graph 4). Istanbul was in second place, but it only had 8% of the vote. Nearly a third of respondents listed Berlin as their second-favourite destination.

Even though the UK and Ireland’s developed market is mature in comparison with other regions of Europe, it was also a clear winner in terms of potential for long-term development growth. Thirty per cent believed this market had the greatest potential.

“This perhaps reflects respondents are being more risk averse than in the past,” says Davey.

No comments yet