The Co-op Bank has pledged to focus on reducing its non-core residential mortgage portfolio after failing the Bank of England’s stress tests.

Three UK lenders, Royal Bank of Scotland, Lloyds Banking Group and The Co-op Bank were judged to have been short of capital at the end of 2013 in the survey of the country’s eight biggest banks and building societies.

However, the Co-op was the only lender to be asked to submit a new plan. Lloyds and RBS were judged to have since provided a sufficient plan to boost their capital strength.

The stress tests were more stringent than the European Central Bank’s tests in October. They envisaged a jump in interest rates to 4% by the end of 2015, a fall in house prices by a third, a rise in unemployment to 12% and a collapse in the stock market of almost a third.

Under the extreme scenario, The Co-op Bank’s capital would fall into negative territory.

In response, the bank said its key vulnerability was its historic higher risk residential mortgages and corporate real estate assets. It said it would focus on the reduction of its non-core residential mortgage portfolio, dubbed Optimum, between now and 2018, which would “significantly improve the bank’s resilience to a severe economic downturn”.

The bank has not been required to raise additional equity.

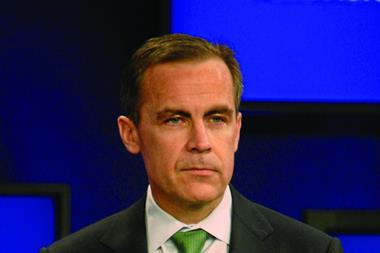

The Bank of England governor Mark Carney said the results of the tests, which would now be conducted every year, showed the core of the banking system was “resilient”.

“This was a demanding test,” he said. “The results show that the core of the banking system is significantly more resilient, that it has the strength to continue to serve the real economy even in a severe stress, and that the growing confidence in the system is merited.”

No comments yet