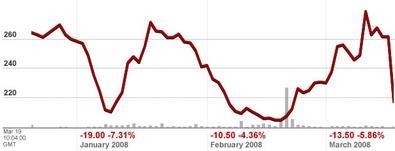

Shares in DTZ plunged 17% this morning after it issued a second profit warning.

DTZ said: ‘In the current volatile market conditions, and in a week which has seen the sudden collapse of Bear Stearns adding to the turmoil in the financial markets, it is more difficult than normal to predict the timing of transactions around our year end.’

DTZ shares fell 17% to 217p. DTZ shares have fallen 75% since their peak at the start of 2007.

Slashed by a third

Analyst Miranda Cockburn at Cazenove, DTZ’s house broker, said in a note this morning she had cut the company’s recurring profit for the year to 30 April by 35% to £20.5m. Cazenove had already cut its 2008 estimate by one third in December when the company announced a downbeat set of interim results.

DTZ said it would take some one-off costs from the acquisition of Donaldsons and the market downturn.

Cazenove estimated that these cash items would amount to £2.5m for the Donaldsons buy and a £2.5m cost due to restructuring DTZ’s cost base.

Loss of goodwill

DTZ also said that it would take a non-cash impairment charge from the acquisition of its US capital markets business DTZ Rockwood, which it said had suffered due to the poor US investment market.

Cazenove said that because DTZ Rockwood is currently making a loss, the impairment on the current goodwill value of £31m could be cut by as much as £10m.

Shares in the employee benefit trust will also have to be marked to market, a reduction Cazenove said could come to around £3m.

![Rob J Headshot[14]](https://d2bq2usf2vwncx.cloudfront.net/Pictures/380x253/8/5/5/1884855_robjheadshot14_607979_crop.jpg)

No comments yet