Politicians and journalists call August the silly season because, like most people, MPs are on holiday. So is most of the rest of the country, and generally not much goes on. So hats off to Property Week, which last week shed light on a couple of significant stories that deserve more prominence.

Politicians and journalists call August the silly season because, like most people, MPs are on holiday. So is most of the rest of the country, and generally not much goes on. So hats off to Property Week, which last week shed light on a couple of significant stories that deserve more prominence.

The first was that Spelthorne Council, having just laid out £285m for the Landid/Brockton Thames Valley portfolio, now has a commercial estate worth £890m. The good burghers of Spelthorne might be slightly perturbed to know that this amounts to more than £22,000 per household and while it is no doubt a perfectly competent authority, one or two industry professionals have already warned there is no evidence it has the skills and connections to get into commercial investment property on this scale. But the real question is why the council got into property investment in the first place.

Find out more - Spelthorne’s real estate spending spree tops £890m

Spelthorne borrowed the money from the Public Works Loan Board. This arcane institution has been going since 1793 and is now an executive agency of the Treasury. It was set up to do what it says on the tin, but in recent years most of the money it lends to public bodies hasn’t exactly gone on public works. There is little doubt that although incredibly, as PW revealed, it doesn’t enquire how its money is spent, we know from other local authority splurges that the majority of its £3.6bn advances last year alone went on councils buying property. And why wouldn’t you if you could borrow money at rates between 1% and 2% for up to 40 years?

So if you ever wondered how Newham Council, one of the poorest boroughs in Britain, could be bidding over £100m for Reza Merchant’s The Collective Old Oak, that’s your answer. In that case, it was at least part of the reason Newham now has a new elected mayor in Rokhsana Fiaz, who made scrapping the deal one of her first actions. And it is not alone – many councils are looking to arbitrage investment returns or development profit from property in various forms.

Around the country, other councils have gone down the route of creating arm’s-length property companies so they can negotiate development freed from the constraints of the Official Journal of the European Union (OJEU), in which public bodies are expected to advertise any major project for public tender.

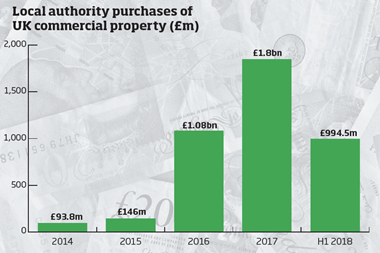

Full data analysis - Local authorities splash out £4.1bn on commercial property

OJEU might make sense when tendering for A4 paper but doesn’t lend itself to optimising property potential when different councils may have very different reasons for wanting to develop. Some, like Barking and Dagenham under Darren Rodwell’s excellent leadership, have concentrated on ensuring regeneration doesn’t mean gentrification. But for others it has quite simply been about selling off their property portfolios for as much as they can get.

“Don’t blame councils for trying every way they can to make ends meet…and don’t be surprised when some of them fail”

There is one inescapable answer as to why local authorities are acting like this – apart from the fact that they can. Every year for the past 20 under governments of all complexions, they have been told to do more for less. While government grant has reduced, they have had to face new challenges such as social care for an increasing elderly population without the means to do so.

Spelthorne says its property venture is “to mitigate the withdrawal of government funding”. It is being polite. The truth is many councils are absolutely desperate. They are blamed for poor services while on average only 17% of the money they get comes from their council tax payers.

Whitehall utterly cynically hides behind them to save money. The truth is our local government funding mechanism is broken. It needs a radical overhaul and frankly a more honest approach to problems we all know we have to face. Until that radical reform happens, don’t blame councils for trying every way they can to make ends meet. And don’t be surprised when some of them fail.

Steve Norris is chairman of Soho Estates and senior adviser to BNP Paribas Real Estate

Having read @g_lanktree’s data analysis on local authority spending (https://t.co/0FSSoRoM8y) we want YOUR VIEWS:

— PropertyWeek (@PropertyWeek) August 23, 2018

Is this year’s £1bn spending spree by local councils a positive thing?

No comments yet