Real estate, it is generally accepted, is a pretty traditional industry. That isn’t necessarily a bad thing.

For instance, there are still huge advantages in meeting people face-to-face, Covid-19 notwithstanding, and sealing a deal as much with a handshake as with a legal document. Such practices build trust and cement relationships that often go on to be mutually beneficial for decades.

However, it also means that property companies can be less inclined to embrace change. That is certainly true when it comes to the take up of digital technology. After all, the portmanteau ‘fintech’ has been around for forever and day, whereas ‘proptech’ only became a buzzword in the real estate industry within the past 10 years. The founding partners of KATE Innovations saw the situation as frustrating initially, but then quickly began to see it as an opportunity.

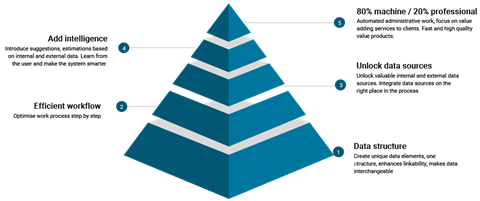

Established in 2016 in the Netherlands, KATE is dedicated to developing digital solutions for the valuation process, allowing property companies to structure their data, optimise their workflow and develop new and future-proof business models. In addition, KATE offers IT solutions that enhance the collaboration of advisers, banks and property owners.

Valuation, of course, starts with data collection, whether that is from internal records, external sources or clients. Collecting and then organising that data in a sensible way is a huge part of a valuation professional’s workload and can be a slow and frustrating process. But it is also hugely important: only when all the necessary data has been gathered and processed can it be sensibly analysed.

This is where KATE comes in. Its solutions are able to collate all the information required, sucking it in from multiple sources, organise it and presenting it in a logical and intuitive manner on a single platform. KATE believes that it has successfully automated around 80% of the work involved in valuation.

Instead of seeing tech solutions such as KATE as a threat, valuation professionals should see them as tools to enable them to do their jobs better and more efficiently

To some, that may sound intimidating. For years now, articles have been published warning of the imminent demise of large chunks of professional services at the hands of algorithms. Headlines along the lines of ‘Be warned: The robots are coming’ abound. Such sentiments are not without a kernel of truth – large parts of what a lot of professionals do can be and indeed are being automated – but they also miss the point.

Instead of seeing tech solutions such as KATE as a threat, valuation professionals should see them as tools to enable them to do their jobs better and more efficiently. After all, the real skill in valuing a property does not stem from data collection. Rather, it comes from using professional experience and judgement to analyse that data, identifying risks that will never be apparent to a piece of software and pulling in on the ground local knowledge.

Viewed in this light, KATE products are actually liberating valuation professionals to spend more timing doing the part of their job that their clients value most.

Given that valuations are often needed within tight timeframes to facilitate a deal, that has to be beneficial to all concerned. Valuation professionals are able to do their best work – the clock will still be ticking but it will be ticking less loudly – and their clients should come out of it with more considered advice.

Fees under scrutiny

It also has to be said that the fees valuers are able to charge are increasingly under greater scrutiny – this is something that has been a real talking point in the industry in recent years. In short, there is considerable downwards pressure on fees.

KATE’s solutions can help on this front. After all, not all of the time saved by automating data collection and organisation needs to be spent on analysis; a good proportion should, no doubt, but a healthy chunk can be spent on other valuations.

As a result, clients will still receive more of a valuation professional’s time working on the part of the process where they can truly add value, but at the same time valuation companies or departments can absorb lower fees while continuing to reap the same rewards and without an impact on margins.

So, those are the basics of the product KATE has developed and it has been received extremely well in the European markets it has targeted so far. But now the company feels the time is ripe to make the push into the UK market, which it views as an exciting opportunity for KATE as a business, having made a start in 2019 before the Covid-19 pandemic struck.

The pandemic, however tragic it has been for many individuals and families – and frustrating for most businesses – has given KATE time to perfect the product it is now bringing to the UK. After all, there are important differences between the UK and other jurisdictions and it is was essential that the company acknowledged this fact and optimised its solutions for the local market.

Most obviously, different data sets are held in different places. So, the work KATE has done ensures that its software can access data from the Valuation Office Agency, as well as data on, for instance, flood risk held by the Environment Agency.

KATE was also mindful of the fact that RICS is justifiably proud of the systems it has in place to ensure professionalism among valuers. As a result, KATE’s solutions are fully compliant with RICS Red Book procedures. Indeed, the company works hard to ensure that it engages with RICS actively, enthusiastically and regularly.

It is clear that KATE’s efforts have been well-received as it is now proud to act as one of RICS’ official tech partners. The status allows the company to contribute to key industry conversations about the future of technology in real estate and gain critical insight into valuation professionals’ priorities.

What all this means is that KATE now has a product that is fully optimised for the UK market and that can be up and running remarkably quickly: the onboarding process can take a matter of days.

However, that doesn’t mean that companies aren’t able to customise KATE’s software. To different degrees depending on the package they choose and the size of the company, clients are able to incorporate their own models into the system so that it works seamlessly with internal processes.

The system also digitises the inspection process, meaning that valuation professionals can undertake inspections of properties they are engaged to value and immediately input data or upload photographs or other evidence live. Their inputs automatically synchronise with the master system, meaning that there is no need to replicate work on site and then back at the office. The process is seamless.

Finally, it is worth noting that the solution KATE offers is not some black box in which information is fed in one end and a solution appears out of the other. Rather, the way in which calculations are made are always fully transparent – and KATE is on the cusp of taking that to the next level. The company will shortly be launching a client portal that will allow the clients of valuers to upload documents into the system directly and receive the valuation back via the same portal.

So, there may have been something of a two-year hiatus, but KATE is now fully geared to push into the UK market. It already has a number of valued clients in the country, but the story is only just beginning.

About Kate Innovations

1. Save 25% in time with more efficient workflows

2. Flexible reporting tools

3. Automate calculations

4. Realtime connections to external data sources

5. RICS compliant

No comments yet