Owners and managers must mitigate future risk to ensure compliance with Minimum Energy Efficiency Standards.

With a year to go until the changes to Minimum Energy Efficiency Standards (MEES) are implemented, their impact is already being felt across all property sectors. To ensure compliance across portfolios, action is required now.

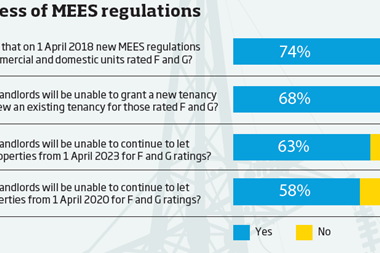

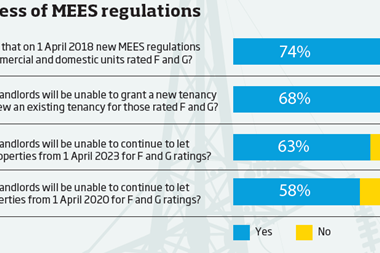

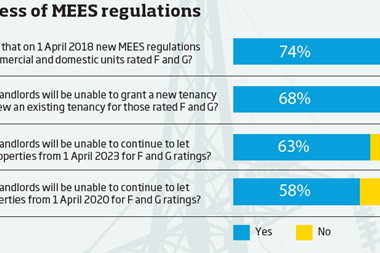

To summarise, from 1 April 2018 the MEES legislation will make it unlawful to let buildings, or renew existing leases, in England and Wales that do not achieve a minimum Energy Performance Certificate (EPC) rating of ‘E’. Scotland is slightly ahead of the game, having introduced section 63 in October 2016.

The focus around this legislation so far has been for investors, owners and asset managers and their agents to understand what EPCs they have, the accuracy of these and the risks presented. With the deadline drawing closer, it’s time to step things up a gear.

Now is the time to start focusing on the practicalities of the legislation and implementing a plan to mitigate any risk in the future. It is one thing to have a ‘clean’ portfolio now, but keeping it like that is the real challenge.

The fundamental message is the need to work with occupiers across all property types as - more often than not - it is the fit-out process that has the biggest impact on an EPC rating and that provides the best opportunity to improve the energy efficiency of stock.

Sustainability clauses - the ‘green lease’

The extent of sustainability clauses in leases vary. At Workman, we recommend they include simple clauses to ensure that (a) occupiers cannot reduce an EPC rating through fit-out or alteration and (b) landlords retain responsibility for all EPCs obtained.

Tenants arranging their own EPCs might not be aware that there are approved consultants, and therefore may not use an appropriate supplier. It is understandable that a tenant may not be concerned by the landlord’s obligations with regard to EPCs, opting for the cheapest provider. It is important to remember that any EPCs obtained will override previous ratings and could present risk unnecessarily.

While it is relatively simple to get to a point where a retail landlord knows what they have and where the risk is, the big challenge is working out when and how to lift the rating of any poor EPCs, to ensure assets are lettable come 1 April 2018

While it is relatively simple to get to a point where a retail landlord knows what they have and where the risk is, the big challenge is working out when and how to lift the rating of any poor EPCs, to ensure assets are lettable come 1 April 2018.

The majority of landlords will not want or need to spend money on improving a unit when in reality the issues causing the poor rating will be stripped out in a few years by occupiers.

It is important to understand and schedule the opportunities - know when the occupier is likely to carry out a refit or alterations and work with them to grasp the opportunities to uplift the rating. For example, factors that property managers can discuss with retailers when considering proposals to refurbish units include the difference between the old-style tungsten lighting as opposed to LEDs or T5s, which is potentially an F/G to a C for no additional cost (and could achieve a saving, as energy consumption will drop), or replacing a rooftop electric air-conditioning system with a new gas boiler and radiators.

The shell-and-core cycle

Another challenge in the current system is the rating of ‘shell-and-core’ units or properties. It is not uncommon for a unit to be handed back stripped out and without an EPC - or it may have a poor rating. The landlord has no intention of fitting it out and just wants to let it, but needs an EPC (or after April 2018, an improved EPC) to do so.

As a shell-and-core asset, a number of elements will be absent and therefore prohibit an accurate assessment of the unit - lighting and heating being the main two. An assessor is required to use defaults, which are all worst-case scenario - tungsten lighting being one example. To let the unit you need an EPC but the EPC you will obtain will be an ‘F’ or ‘G’ so you can’t let the unit.

While the system is far from perfect, there are options for those who are thinking this through now.

By ensuring a good EPC now, regardless of the changes made as a unit is stripped out, that EPC (assuming it is in date) will stand for a new letting. The EPC can be re-run at a later date to reflect the new fit-out if it is felt the rating can be improved. Therefore, it can pay dividends to obtain an EPC now to avoid having to obtain one on a shell-and-core unit.

Case law and dilapidations

The nature of dilapidations is such that exact interpretation will remain mired until case law is developed through the courts. At this stage, the general consensus across the industry is that a landlord will not be able to enforce the upgrading of a unit beyond an ‘F’ rating through the statutory compliance clause, unless the default is directly due to the tenant fit-out.

In many instances the work necessary would be likely to constitute an improvement, which is generally not recoverable under dilapidations. There will be exceptions to this, such as when an element is being replaced due to disrepair. In this instance we recommend that the element is replaced with an equivalent with greater efficiency.

Find out more: Dilapidations: a two-way street (by Matthew Pateman of Workman)

Another aspect of dilapidations that could be affected by the legislation is the supersession principle, which in this case leaves the potential for a tenant to claim that their repairing obligation is somehow limited by work a landlord may otherwise need to undertake to comply with their obligations.

While there remains ambiguity at the early stages, it is essential to seek dilapidations advice well in advance of lease expiry because there are many factors that will affect a dilapidations claim. As with all negotiations, it is much better to approach well informed and with all eventualities considered.

New leases should be drafted in a way that is more prescriptive regarding the energy efficiency requirements at lease expiry.

Sustainability, acquisition and disposal

Purchasers now need to place more focus on the sustainability of an asset being acquired than they have previously done. An assessment of the quality of the EPCs will be required and a fairly urgent understanding of any implications of poorly rated assets, along with budgets for the work, will be necessary to aid a purchaser in their price negotiations.

The expiry date of a seller’s EPC is now an important consideration in a purchaser’s investment strategy and dates should be cross-referenced against other key lease events.

For sellers, it is important to be able to demonstrate a robust strategy proving how any potential risk can be mitigated. This will enable negotiation to be led from the front foot.

In many cases where a rating of ‘D’ or less is offered up by the vendor, we consider it prudent that a new EPC be obtained. Often there is no contractual link between a purchaser and the provider of an existing EPC. This creates a scenario whereby should an EPC be found to be inaccurate in the future there will be no recourse for the purchaser.

Workman has been assisting clients with their EPC strategies for several years now. Once the true risk has been identified, our clients routinely ask us to use our property-specific and building consultancy expertise to carry out desktop reviews of the works that are genuinely required - and that will have maximum impact on EPC ratings - and to put budget costs against them.

It is an exercise that takes EPC strategy from a schedule of ratings and turns it into an action list to inform asset managers.

Vicky Cotton is environmental and sustainability director at Workman

About Workman

Workman is the UK’s largest independently owned commercial property management and building consultancy firm employing more than 630 staff across 11 UK offices, with a growing presence in Europe. Specialist property management and building consultancy teams work with a client base that includes leading institutional funds, investors and property companies. Workman’s specialist focus, national coverage and independent status has been the foundation of the firm’s growth for more than 30 years.

No comments yet