The government has been warned it will face a backlash from businesses around the country facing either huge hikes in rates or much smaller falls than anticipated.

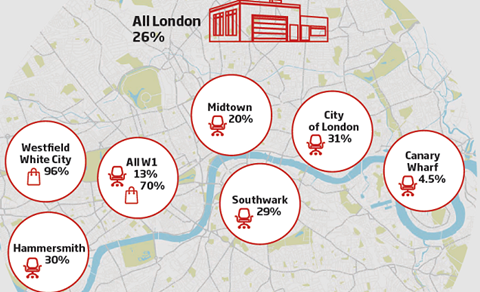

Following the release of new draft rateable values last week, properties in London’s West End are set to see hikes of 75% to 100% in their rateable values, with shops on parts of Bond Street and Marylebone High Street in for a 250% rise and units in Westfield White City set for a 96% rise.

Under the government’s proposed method for transitional relief - the system allowing rates changes to be phased in over a period of up to five years - ‘large’ business with bills of more than £100,000 could be hit with increases of as much as 45% in the first year of the new system, rather than the previous initial 12.5% cap.

Under the scheme, which the government is consulting on until 26 October, businesses expecting a sharp fall in rates were also disappointed: ‘large’ businesses that are in line for a reduction in bills will see that capped at 4.1% in the first year.

“There are no real ‘winners’,” said Emily Francis, national head of business rates at BNP Paribas Real Estate. “On the one hand, retailers in the West End will on average see increases in rateable value of around 100% and up to 250% in extreme cases, although transition will taper their liability at around 50% per year.

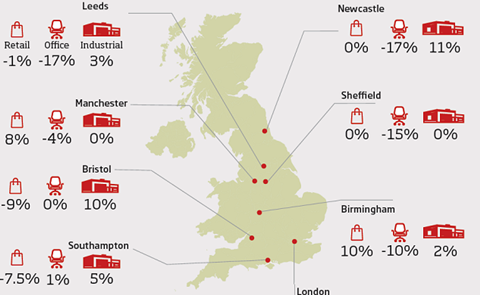

“On the other hand, many businesses outside London that are quite rightly expecting a significant decrease to their rates bill will see the transitional phasing result in measly decreases. Barnsley is indeed paying for Bond Street.”

Join the great rates debate with #ratesdebate alongside @BNPPRE_UK and @propertyweek next Monday

Rates have been based on 2008 values since April 2010, but the new ratings are based on 2015 values and apply from April 2017.

“If you postpone revaluation and leave it for seven years, then you will inevitably see massive rates increases in the best areas and slides in the worst areas,” said John Webber, national head of rating at Colliers International.

“This is the chickens coming home to roost and the government will have to deal with a big backlash. Nobody thought it would be going up that much in the first year.”

As expected, bills are set to fall for businesses outside the capital. Values of stores at the Bullring shopping centre in Birmingham are set to fall by 23%, while those at WestQuay shopping centre in Southampton are set for a 32% drop, with a 41% decrease expected for retailers on the high street in Leeds.

“This would be most welcome if such decreases transcended directly into bills, but the proposed transitional phasing scheme means retailers may never actually see the full reduction materialise,” said BNP PRE’s national head of retail Patrick Heaps.

No comments yet