Dirty money has no place in the UK. Criminals who seek to use this country as a place to launder their ill-gotten gains should know that they have nowhere to hide.

The government has already taken tough action against Britain’s crime barons, using the Criminal Finances Act and tools such as unexplained wealth orders, and is keeping the pressure up. The new National Economic Crime Centre will ensure our response has even greater impact in future.

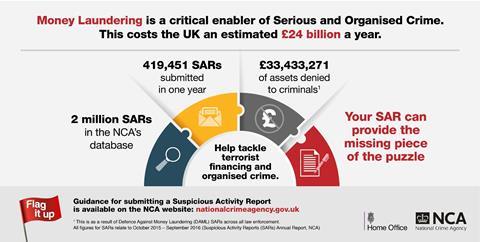

But government can’t do this alone. Agents, lawyers and accountants have a crucial role to play. Yes, they might be eager to close that big deal – but they must not close their eyes to the warning signs. If something about the transaction doesn’t feel right, the onus is on them to flag it up via a suspicious activity report (SAR) to the National Crime Agency.

The government’s Flag It Up campaign, working with partners across the property, legal and accountancy sectors, is designed to help property professionals spot the signs of money laundering. The campaign will be promoted across LinkedIn and digital advertising on professional websites as well as on social media and at industry conferences.

However, it’s really up to you to know the signs. Is your client being evasive or contradictory? Do you have a feeling that the source of that large sum of money might not be legitimate? Are you wondering why they need to use so many different bank accounts?

Flagging up those concerns by submitting a SAR means you are doing the right thing by your country. Our world-class professional services are crucial for our prosperity and anything that damages the reputations of these sectors has a corrosive effect on the rest of society.

Money laundering is not a victimless crime. Those with dirty cash to clean don’t just sit on it – they reinvest it in serious organised crime, ranging from drug importation to child sexual exploitation, human trafficking and even terrorism. Money launderers are dangerous individuals, the kind who wreck lives, legitimate businesses and our national security.

Legal and moral obligations

Property professionals are a crucial line of defence against these criminals and that’s why they are under a legal obligation, as well as a moral one, to file a SAR when they spot something is amiss. Those with nothing to hide have nothing to fear.

In really serious money laundering cases, a high-quality SAR can provide crucial intelligence to help law enforcement agencies build up a profile of criminals and prevent them committing further crimes.

We are working with the property industry to reform the regime, to not only ensure that law enforcement agencies are able to use SARs more effectively but also to make the submission process easier and more efficient.

Choosing to turn a blind eye or not looking closely enough could have major consequences, both personally and professionally. Not only could you damage your firm’s reputation if you let something slip through the net – you could lose your licence or even face prosecution if you are found to have facilitated money laundering.

Please do your bit to help – it really matters and our collective efforts are already paying off. For example, earlier this year, the UK moved up Transparency International’s world rankings of the least corrupt countries from 10th position to eighth.

We are determined that together we will keep up the momentum and send a message loud and clear to criminals who want to launder their ill-gotten gains in this country: it simply will not wash.

No comments yet