Housebuilder Inland Homes has lost its fight for survival and has confirmed it will enter administration.

FRP Advisory, which had already been advising the business and conducting a review, is set to be appointed administrator to the business, which will stop trading on the Alternative Investment Market (AIM) on 4 October.

In a stock market statement, Inland Homes said: “Inland has reviewed options to continue its policy of seeking to complete existing construction projects at the same time as undertaking a comprehensive programme of disposals of its land assets.

“Taking into account the current circumstances and including the group structure and the current cash resources available to it, Inland has concluded that the appointment of administrators is in the best interests of all stakeholders.”

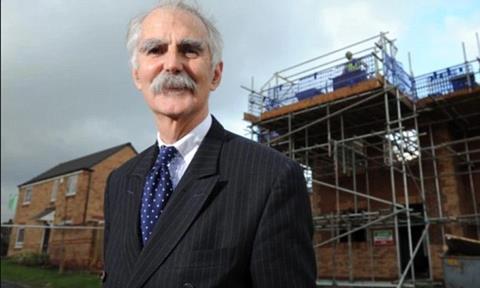

The collapse of the firm brings to an end efforts by housing veteran Jolyon Harrison to sell his NorthCountry Homes business to Inland as part of a complex rescue bid.

The proposed deal amounted to a reverse takeover that was designed to salvage the Inland operations while gaining an AIM listing, and saw Harrison appointed chief executive to head a new management team.

The statement also revealed that July’s announcement of Inland’s proposed £4m acquisition of NorthCountry Homes as part of a strategy to develop a low-cost homes business model, was contingent on the restoration to trading on AIM of Inland’s shares, which have been suspended since April.

Earlier this month, Inland revealed that its development subsidiary had breached lending covenants.

In a statement to the London Stock Exchange, the group told investors it had advised lender HSBC that its subsidiary, Inland Homes Developments, was in breach of certain covenants in relation to a £13.6m debt facility guaranteed by Inland Homes.

The audit of its results for the year to 30 September 2022 started in November and the audit committee has regularly met with its auditor PwC.

The group has also faced an exodus of senior staff in recent months. Chief executive Don O’Sullivan quit in January after just six weeks in the job, while the rest of the board, excluding Nishith Malde, quit six weeks later.

No comments yet