The latest IPCC report made clear that the challenge of achieving Net Zero assets and funds should remain both a wider societal and property industry imperative; yet understanding on a building by building level what needs to be done can be something of an enigma for many participants in the property industry.

With so many accreditation schemes, benchmarks, best practice guides and definitions to work to, being able to cut through the noise and define an informed, bespoke cost optimal plan for an asset remains a challenging priority for many.

Andries Van Der Walt, Head of Real Estate at Verco says “We are seeing ever more complex requirements being placed by investors on asset managers, knowing which to prioritise and how to meet them is a key differentiator of market leading REITs and asset managers and the buildings within their portfolios. Initiatives driving the market forwards in the coming years will include NABERS operational energy ratings, Design for Performance principles for new developments and deep occupier engagement. Whilst these services will be critical to achieving Net Zero, the first key step is to define a building level net zero pathway and implementation plan.”

Discussing these challenges with Dave Worthington, Verco Managing Director, it becomes clear clients are demanding both overall strategic clarity and site specific detail; “Being able to define a clear and comprehensive Net Zero plan for an asset allows clients to plan ahead and understand the decisions they need to be considering well in advance of when they need to be made. Site level details including the technical viability of specific measures and capital spend requirements enable no regrets investment in improvements whilst the market landscape continues to evolve.”

The impact of “moment in time” audits can be magnified many times over when they’re combined with an asset management philosophy which embraces the requirements of Net Zero in every day decision making. As Dave Worthington goes on to explain, “We’re seeing ever increasing demand for strategic advice which addresses whole asset lifecycle and whole life carbon requirements, supports decision making and embeds Net Zero into asset management culture, processes and procedures. The clear imperative is to capitalise on key intervention points when they arise, avoiding “carbon lock in” due to poorly informed decision making and ill-defined processes.

For companies with multiple assets under management, the complexity of the challenge becomes ever greater as assets enter and leave the portfolio. Identifying the right assets to acquire can accelerate improvement, whilst selecting the wrong ones can dilute or counteract the benefit of interventions across the portfolio.

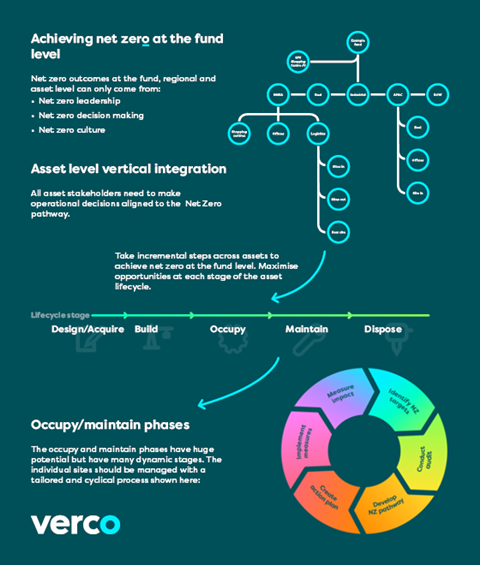

The infographic below shows how Verco works with asset owners and managers to approach these key challenges. Download the ebook: A pathway to net zero assets, which will help you to explore key challenges such as data collation and benchmarking, decarbonising heat and how to implement identified interventions as well as the key challenge of engaging and collaborating with occupiers to set them on a course to reduced energy consumption and carbon emissions.

The ebook will give you a feel for how to achieve a holistic net zero strategy. You will see an overview of the net zero interventions that can be made at each stage of the asset lifecycle and get an understanding of the cyclical process that should be used at the occupy and maintain phases of the cycle and the important considerations and actions that can be taken at each step.

No comments yet