Amid fierce winter market headwinds – a perfect storm of inflationary pressures, high interest rates and a flatlining UK economy – it’s not easy for fund managers to generate positive returns. Investors, in the rare instances where they are willing to deploy capital, are all looking for the same thing: value-add returns at core-plus risk.

With valuations continuing to fall across all sectors, it can be difficult to see where the best opportunities lie. Yields on good-quality London and regional city-centre offices may well be attractive, but there remains considerable downside risk. Rental growth is likely to remain strong across living sectors, but development or operational risk is required to deliver higher returns. So, what about logistics?

According to MSCI, logistics values fell by 27% between June 2022 and March 2023. There was a brief rebound of confidence in Q2, but that seems to have dissipated, and industrial yields are weakening once again. There are now pockets of new-build over-supply appearing in certain locations such as South Yorkshire.

When meaningful capital returns to the sector, it will pay for the ability to access scale

So, while it doesn’t look as if logistics is going to get us out of a hole again as the sector did post Brexit and Covid, that doesn’t mean there aren’t opportunities for those prepared to look beyond the headlines and roll up their sleeves.

We have seen a real discount, confirmed by MSCI data, for single industrial assets in the £5m to £10m range consistently over the past decade. The recent price correction means that good-quality, smaller assets can now be purchased at strong initial yields given embedded rental growth. We haven’t seen this value for many years.

The pricing of these assets is well below replacement cost, which means it is impossible to increase supply at this price point, a key factor to drive future rental growth performance.

The other key driver, in the expected absence of another significant market-yield shift, is the ability to generate a portfolio premium at exit. When meaningful capital returns to the sector – and it inevitably will – it will pay for the ability to access scale, as we have seen in all previous market recoveries.

Of course, aggregation plays focusing on smaller units come with drawbacks, and they aren’t always economical assets for funds to manage. Acquisitions of multiple smaller assets can create significant transactional inefficiencies that threaten to negate any economies of scale achieved by holding many of these properties.

Conventional wisdom might suggest that the largest funds, with more resource and capital, can manage such inefficiencies well, but it’s often the case that significant bureaucratic pressures make aggregation plays difficult for them. This is why this strategy is often better executed by UK local specialist fund managers, who generally have fewer levels of bureaucracy and can be more flexible.

Significant opportunities

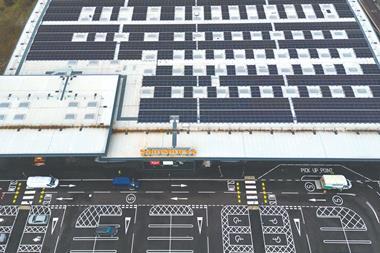

Similarly, some funds will be put off by poor energy performance certification on such assets – a common problem for smaller industrial units. The initial investment needed to ensure compliance can be a drag on yields. But for well-capitalised asset managers and those willing to remain focused on sale price further down the line, there are significant opportunities to drive outperformance.

With well-placed investment, revenue can be added through the provision of upgrades, such as EV chargers on site and the ability to provide occupants with power from solar panels.

Another concern for investors, given the current economic climate – and considering the typical target occupant for smaller units – will be the threat of SME failures. Insolvencies are at their highest rate since the financial crisis of 2008- 09, and as it’s not clear whether failures have peaked, some hesitancy is understandable.

While not immune to their impact, the diversification present within aggregated small and mid-box portfolios offers a significant hedge against the impact of occupant churn and inflation. Ultimately, despite economic conditions, occupier demand for these units remains robust, and with inflation falling we may be through the worst.

Ultimately, discounted purchase prices, higher yields, great refit opportunities and premiums upon exit are making small and mid-box industrial and logistics units an asset class worth reassessing in these turbulent economic times.

When capital returns to real estate markets, aggregated portfolios of energy performance certificate-compliant units will come into their own. Naturally, such strategies won’t work for every fund, but for those willing to invest in upgrades and be flexible enough to manage multiple smaller assets, there are significant returns to be made, generated by the high running yield and steady asset management: value-add returns at core-plus risk.

Rob West is managing partner at Clearbell Capital

No comments yet