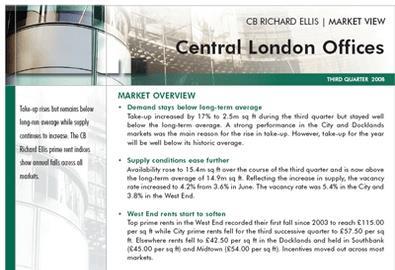

Take-up in the central London offices market increased by 17% to 2.5m sq ft, finds CB Richard Ellis’ research into the third quarter.

A strong performance in the city and Docklands markets is cited as the main reason for the rise in take-up. But the figure remains well below the average for this time of year.

The Q3 research also reveals that:

- Availability in central London continued to rise and over the course of the quarter moved above the long-term average to 15.4m sq ft.

- Top prime rents in the West End recorded their first fall since 2003 to reach £115.00/sq ft, while city rents fell for the third successive quarter to £57.50/sq ft.

- Investment levels remained subdued with only £1.2bn transacted in Central London

To read CBRE's full report click here

No comments yet