The depth of concern across the UK commercial property industry about the impact of Brexit has been laid bare in two definitive surveys this week.

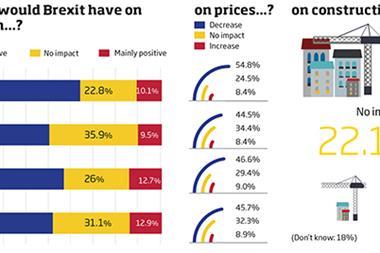

The first, undertaken by Property Week, found that 61% of respondents believed leaving the EU would be “mainly negative” for the commercial property market, while 23% said it would be “mainly positive”.

The survey of more than 500 property professionals revealed fears that Brexit would have a negative impact on all main sectors of the industry – offices, retail, industrial and residential – although offices was singled out as the market likely to be worst hit, both in terms of investment and occupier demand.

Unsurprisingly, the survey found that with the EU referendum now just a month away, the majority of respondents (60%) intended to vote to remain in the EU, while 36% said they would opt to leave.

Particularly bleak among investors

The findings are supported by a separate survey by law firm Nabarro, which found that 63% of respondents were pessimistic about the prospects for the commercial property market should the UK leave the EU.

The survey of more than 300 investors, developers and advisers, which together oversee portfolios worth more than £350bn, found the mood was particularly bleak among investors: 68% said they would be pessimistic in the event of a Brexit, and only 11% said they would be optimistic.

Developers were slightly less downbeat about Brexit, with 51% saying they would be pessimistic and 23% optimistic.

The survey findings come as Land Securities chief executive Rob Noel this week warned that the UK was facing “a period of greatly enhanced economic and political risk” and that Brexit would have a profound impact on property and the wider economy.

‘Brexit is a leap into the unknown’

“I think a leave vote would bring uncertainty for business and have an impact on decision-making, which leads to a propensity for demand to fall. We are in a supply-and-demand market,” he told Property Week after the company announced its results.

“A vote to leave would have an impact on demand and what is a landlords’ market would become a tenants’ market. That’s basic economics. The short-term impact at least would be a downturn in demand.”

Ciaran Carvalho, Nabarro senior partner, said fears over Brexit were leading to a “marked increase” in the number of contracts that included clauses to protect the position of buyers investing in UK real estate ahead of the referendum.

“Brexit is a leap into the unknown. Brexit clauses are a pragmatic, legal response to that uncertainty,” he added.

Nabarro EU referendum survey

Dependent on the outcome of the Brexit vote, how optimistic or pessimistic will you feel about the UK real estate market in the short term?

If UK exits the EU:

All:

Optimistic: 14%

Pessimistic: 63%

Neutral: 23%

Investors:

Optimistic: 11%

Pessimistic: 68%

Neutral: 21%

Developers:

Optimistic: 23%

Pessimistic: 51%

Neutral: 26%

Agents:

Optimistic: 11%

Pessimistic: 58%

Neutral: 31%

If the UK stays in the European Union:

All:

Optimistic: 68%

Pessimistic: 5%

Neutral: 28%

Investors:

Optimistic: 61%

Pessimistic: 6%

Neutral: 33%

Developers:

Optimistic: 70%

Pessimistic: 4%

Neutral: 26%

Agents:

Optimistic: 77%

Pessimistic: 5%

Neutral: 19%

No comments yet