Bill Hughes has been increasingly vocal on the need for greater institutional investment into housing. He believes there is huge scope for a more progressive approach to planning, construction and investment.

What are some of the low-hanging fruit we can pluck to drive supply over the short-term?

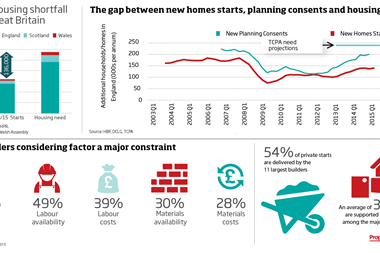

The crucial thing is getting the planning system to deliver more permissions. I believe planning departments should have a centrally mandated obligation to deliver a certain number of housing permissions. It was one of the recommendations of Lyons Review that I was involved with. Part of the problem comes down to resources, but some clear guidance from the government may help.

But of course this will only achieve so much…

Yes, and so the other thing that really needs consideration is the overall capacity within the housebuilding sector. On reflection, investors like L&G need to prioritise investing in non-cyclical, income-producing property: Build to Rent, student accommodation, retirement living and social housing.

So institutions should pick up the shortfall in housing supply which has largely existed since state-funded development ceased?

Correct. We need to be more progressive in our attitudes towards investment and also in our approach to construction, particularly given current issues around costs and human resources.

In what way do you mean?

Housebuilders are tied to materials and labour costs within traditional methods of construction. This needs reviewing. A very appealing and relatively unfulfilled area of opportunity exists around offsite construction. So the factory production of a-cyclical residential is a massive opportunity for the UK. It could help increase output and cost-efficiency and drive an enhanced offsite construction sector for the country. It is not the same as finding more bricklayers and it is not the same as finding more electricians on-site - it’s a different mode of operation.

What role do you see Build to Rent playing in upping delivery quickly, which is a critical political concern?

Rental property in urban areas currently represents about 20% of stock, but it should really represent about 30% to 40%. On larger developments, the rate of progress can be accelerated, as statistics suggest you can rent properties six to eight times faster than you can sell them. This generates an income stream for the investor and a thriving pre-existing community for new tenants.

And where do you see things sitting in 10 years’ time?

I think within 10 years we’ll have a sector that will become established into a much bigger part of the investment universe: expertise, professionalism, benchmarking and an increasing level of transactions will make a significant material contribution to resolve the housing supply crisis.

How much appetite does L&G have for residential investment?

We think the whole of the UK’s institutional world, including L&G, is massively under-invested in residential. So we are looking at all opportunities very positively. I don’t think we’re anywhere near fully allocated. I’m responsible for, in aggregate, just under £20bn of investment and we currently have less than £3bn in housing. I believe there is potential to double that without any concern about total allocation.

Few companies boast the scope and brand awareness of L&G across business and consumer audiences. As society ages and investment and technology evolve, should there be a responsibility for greater cohesion between private capital, the creation of physical buildings and investment in solving social issues such as health and education?

I think this is a very important point and L&G, given its wider canvas, is in a very strong position to collect those ideas together. I agree we have an ageing population and an under-funded healthcare system, so you need private capital, technology and bricks and mortar to come together and provide solutions.

Our national budget deficit means the government has to involve private capital in providing solutions. L&G is a long-term aggregation of capital on behalf of the people. The individuals in the ageing population you refer to are those same people who hold pensions and savings with us, for us to reinvest in 21st century society. There are huge challenges ahead but with them many opportunities.

Bill Hughes is recent past president of the British Property Federation and head of real assets at Legal & General Investment Management

No comments yet